Dental implants are a fantastic method of replacing missing teeth. They look natural and provide excellent function. However, they aren’t cheap. If you want to get them done, you’ll need to save up for at least six months before the procedure.

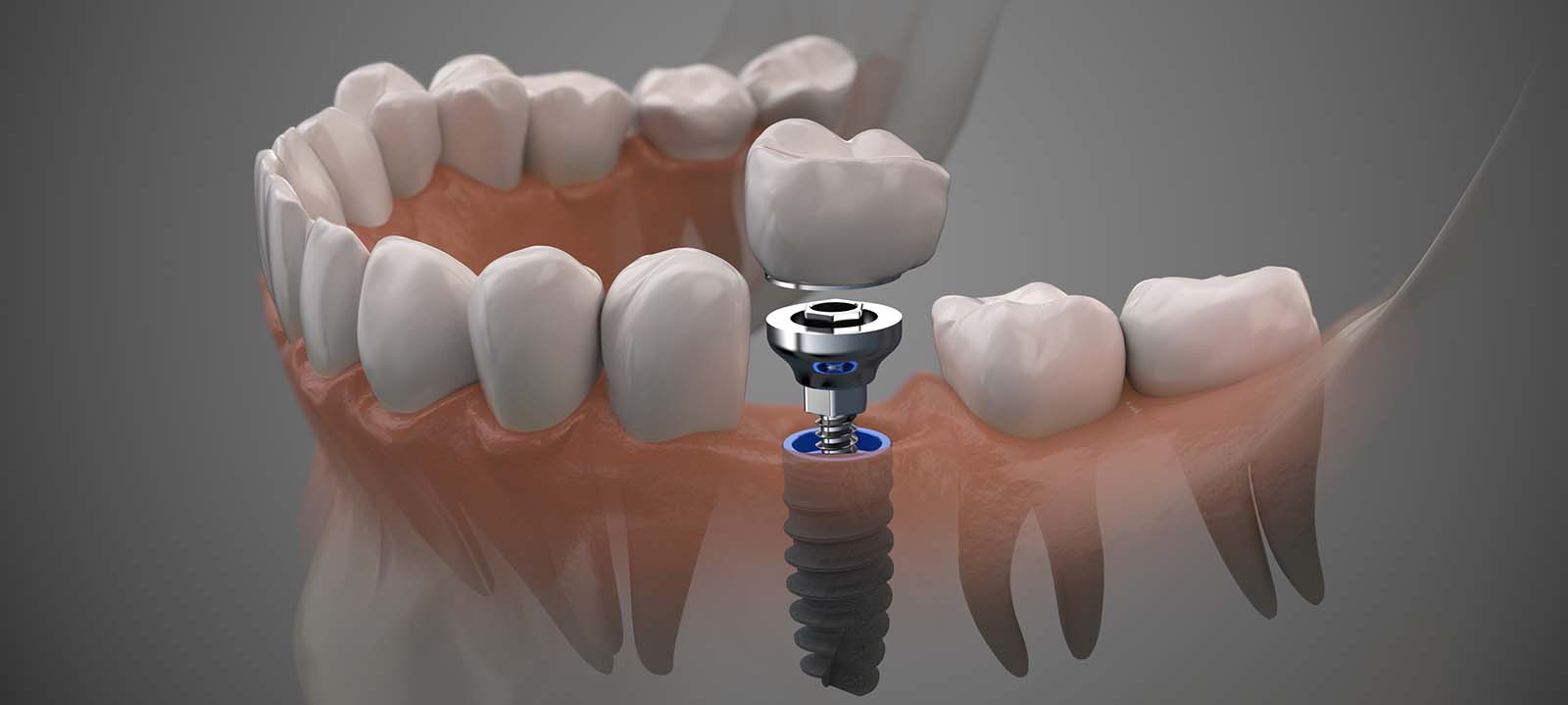

Dental implants are artificial tooth roots placed into the jawbone. They are usually made from titanium or ceramic materials. The dentist drills holes into the bone where the implants will go then put them. Once healed, the implants support crowns that look and feel like natural teeth.

You’ll need to visit your dentist and discuss your options to get started and get the best payment plan for dental implants. He’ll take X-rays and create a treatment implant payment plan. Then he’ll place temporary implants in your mouth until the permanent ones are ready. Afterward, you’ll need to wait for several weeks before the final implants are installed.

According to Dr. Delaram Hanookai, the total cost of tooth implants depends on how many teeth you lose and whether you choose fixed bridges or removable dentures. Continue reading if you’re interested in getting tooth implants but haven’t saved up enough or don’t have any dental insurance covering implants.

Dr. Delaram Hanookai from Southland Dental Care offers various ways to replace their missing teeth through in-house financing dental implants.

What Is In-House Financing Dental Implants?

House Financing tooth implants are an excellent way for replacing missing dentures instead of traditional methods of paying upfront to get a set of implants. This allows patients who may not afford this type of procedure to receive the benefits still. In-house financing dental implants are also known as “in-house financing tooth implants” or “financing tooth implants.”

Having in house financing dental implants starts with the patient visiting their dentist and discussing the possibility of going ahead with tooth implants. Here you will get the total cost of full mouth dental implants cost and more information on the full mouth dental payment plan.

Various dental implants payment options are available depending on the amount of money the individual has saved.

The most common types of dental insurance include:

- Self-Pay Plans – The dental implant payment plan does not cover any part of the dental care costs.

- HMO (Health Maintenance Organization) Plans – HMO dental implant payment plan often offer partial coverage for preventative services such as cleanings and checkups.

- PPO (Preferred Provider Organizations) Plans – PPO plans typically allow members to see a list of doctors, hospitals, clinics, and other health practitioners within the network.

Members must pay monthly for dental implants premium of around $20-$100 per month, depending on the specific dental implant payment plan. Some plans require members to use only certain providers within the network; others permit members to select among all covered providers. Some employers offer compassionate care plans to supplement employee medical insurance.

What Is the Price of a Dental Implant?

If you opt for traditional full-arch fixed bridge restorations, the best dental implant payment plan ranges between $3,000 and $7,500 per tooth. A single tooth implant can cost anywhere from $1,200 to $2,800, depending on its design, placement, and length. For partial denture cases, prices start around $4,000 per tooth.

For an individual tooth replacement with a crown in Southland Dental Care, the best payment plan for dental implants varies based on size, the material used (ceramic or porcelain), and any additional cosmetic enhancements. Typically, the more work involved in making it perfect, the higher the price.

If you decide to get multiple implants at Southland Dental Care, this may be less expensive than other methods. You will also get in house financing tooth implants. Fixed bridges generally require several implants, while partial dentures only use one. In these situations, multiple implants tend to be cheaper than traditional treatments.

You might not think about saving money when you make plans for your smile, but if you do a little planning ahead of time, you could end up spending much less on dental implants. If you’d rather avoid the hassle of saving, consider taking out a loan. You could borrow up to $20,000 to cater for a tooth implant payment plan typically paid back over ten years.

Borrowing money isn’t always an option. But if you’ve got some extra cash lying around, you might as well put it toward something you care about. It’s never too early to start thinking about your future dental health and how to finance dental implants.

see also $399 Dental Implants

Are There Payment Plans For Dental Implants?

Yes! Some people prefer to have a dental implant payment plan through dental insurance that covers implants, which means they won’t have to pay out of pocket. Others prefer to pay for their treatment upfront to focus on their recovery without worrying about finances. Either way, most dental implant companies offer flexible financing options.

Some providers accept credit cards, while others require patients to apply online using a secure website. After filling out the application, you’ll receive an approval within 48 hours.

Once approved, you’ll be given a prepayment repayment option and a timeline for payments. Be sure to follow all instructions carefully. Otherwise, you risk paying too much at once or missing deadlines that could delay your treatment.

Most teeth implant companies allow you to set up automatic dental implants monthly payments deductions from your checking account. You should still contact them directly to find out your exact payment amount. This is important because each provider has different interest rates and fees policies.

All on 4 Dental Implants Financing

The best way to finance your teeth implant costs is through all on 4 dental implants payment plans. Your dentist can help you determine dental implants payment options right for your situation. The process takes just minutes, and you don’t need to fill out any paperwork. Just stop by your local office and ask.

All on 4 dental implants financing options for individuals looking for ways to save on their dental implant payment plan. Tooth implant costs for the all on 4 payment plan vary widely depending on the type of treatment required. For example, crowns can range anywhere between $1,500 to $2,500 per tooth.

On the other hand, Porcelain veneers tooth implant payment plan can cost upwards of $5,000 per tooth.

[See Also: all on 4 dental implants Los Angeles]Dental Implants with Payment Plans near Los Angeles

In Los Angeles, the payments for the total cost of dental implants vary considerably due to the high cost of living here. Some people have found ways to finance their dental implants by funding CareCredit.com. This site allows patients to apply online for dental implants payment plans in Los Angeles for a personal loan for tooth implants to cover most of the cost of dental implants. Care Credit offers flexible repayment terms for dental implants with payment plans near Los Angeles so that patients can pay off the entire amount in 3 to 5 years. [See Also: Dental Implants Los Angeles]

Establishing a Payment Plan for Your tooth Implant Treatment

Before your tooth implant surgery, you need to establish a payment plan for your dental implants. The first step is to contact your dentist and ask them to estimate how many implants are required to replace your teeth. Once you know how many implants are needed, you can determine the approximate costs and how long it will take to complete your tooth implant treatment.

The next thing you need to do is choose a financing company that best fits your needs. Many companies are offering dental implant financing programs today. However, you must understand precisely what type of program works best for you before choosing one.

If you’re looking for how to finance dental implants and planning on getting a private loan for teeth implants, you may want to consider Care Credit. They have implant financing options, and for instance, they offer several financing plans explicitly customized for people who don’t qualify for traditional loans. Their financing plans range from 2 years fixed rates to 10-year variable-rate programs with no prepayment repayment penalties. In addition, they offer zero percent intro APR for 60 months and low rates that start at 12.99% after 60 months which is an average cost of dental implants.

Other financing companies like American Express also offer payment plans for specific treatments. These include cosmetic dentistry treatments like veneers, crowns, porcelain veneers, bonding, tooth whitening, caps, root canal therapy, etc.

Other implant financing options include:

- Payday Loans

- Cash Advances

- Title Loans

- Lines Of Credit

- Installment Loans

Dental Implants Payment Plans in Los Angeles California

If you are looking for dental implants in Los Angeles with payment plans or a way on how to finance your full mouth dental implants payment plan, that is right for you. You’ll need to provide detailed information about yourself, including your income, assets, debts, employment history, current insurance coverage, credit rating, and other information. You may also need to submit a few documents to prove your identity and residency status.

Once you’ve established all on 4 payment plan, you can make regular payments by using an automated system or making paper checks. If you use a computerized system, you can usually save time and money by electronically sending all of your bills. Electronic billing systems are available in most major cities across America.

You can also talk to your dentist about establishing a payment plan during your initial consultation. They will discuss various options with you and help you select the right plan for you. It’s important to remember that not all financing companies will allow you to repay your loan early.

Your dentist should be able to inform you whether or not you qualify for any special financing deals that might be offered. For example, if you’re receiving Social Security benefits, some financing companies might accept them as proof of financial stability. Also, if you own real estate, you could acquire special financing rates because you have equity in your home.

You should always check with your local bank before applying for a prepayment repayment plan. They may require additional documentation or charge higher fees than other lenders. You can find out more about this by calling their customer service department.

How To Afford Dental Implants Cost?

Many people tend to think that it’s a tedious task when planning how to afford dental implants. However, this is not the case. Planning ahead of time, getting loans, and insurance are various ways to help you afford the heft prices associated with tooth implant without breaking the bank.

Getting dental payment plans in Los Angeles, How to afford the cost tooth implant procedure costs

The first step is to schedule a free consultation to get full mouth dental implants. During the appointment, our dentist will take a series of X-rays and photographs so they have a clear picture of what you’d like treated. Then, we’ll review the results and determine how much it would cost to perform the treatment.

The next step would be scheduling the actual procedure. Your doctor will remove a small amount of bone around your jaw and place it into titanium cylinders. Titanium is a solid metal that resists decay and helps the implants last longer. Once the implants are in place, they will cover them with a thin layer of soft gum tissue called gums.

This process takes anywhere from two weeks to six months, depending on the type of treatment you choose.

After completing the procedure, you’ll go through several healing stages. Depending on the type of treatment performed, you may experience some discomfort. However, once the implants heal completely, they’ll look just like your natural teeth.

If you want to learn more about getting affordable dental payment plans in Los Angeles, contact us today! We’d love to speak with you about the services we offer and how we can improve your smile.

Flexible Spending Account Payment Plan for Dental Implant Procedures

Dentistry offices often provide flexible spending accounts (FSAs) to patients who need financial assistance paying for medical treatments. These accounts let you pay for qualified expenses over some time without having to worry about incurring extra charges. FSAs are only available to people whose employers offer these benefit programs.

Most dentists’ offices like offer FSA plans; however, there are some limits to which types of treatments are eligible.

Typically, you can’t use an FSA to pay for:

- Cosmetic surgery

- Dental crowns

- Grafting

- Periodontal therapy

- Root canal work.

However, there are several other options you can use to get the dental implant financing, including:

Credit Union

Many credit unions offer low-interest loans for medical purposes. Some even allow members to borrow money besides healthcare, such as tuition payments.

Check with your nearest credit union to see if they offer to finance dental implants. If they do, ask if they also provide financing for other procedures such as cosmetic dentistry and orthodontics. You can also call your state’s Department of Financial Institutions to inquire about all possible banking alternatives.

Personal Bank Loan

A personal bank loan is another option. Many banks offer low-interest rates for short-term loans for medical purposes. The key is finding a lender that offers competitive terms. You should always shop around for the best rate.

Federal Student Loans

Another way to finance dental implants is to apply for federal student loans. To qualify for this type of loan, you must earn less than $50,000 per year or have a household income below $60,000 annually. In addition to the benefits of traditional school education, most private schools offer financial aid to students attending their institution. Most institutions provide free tuition to residents of certain states, so check with the school before applying for federal student loans.

Private Insurance Plans

Some insurance companies offer additional coverage for tooth implants. For example, Delta Dental offers a plan that covers the entire cost of replacing missing teeth up to $20,000. Ask your dentist what their office provides under its insurance policy.

Credit Card

You can also consider using a credit card to cover the cost of dental implants. This approach works well when you don’t know what you will be charged until after the procedure has been completed. It does require that you pay back the amount owed in full within 12 months from the date of purchase.

The following table lists expected costs for dental implants. Keep in mind that prices vary depending upon where you live, your dentist and whether you choose to include any additional services.

Dental Insurance

If you have dental insurance, it may cover many of the costs associated with dental implants. However, there may be restrictions on how much you can spend on dental care each year. Also, not every dental insurance company pays 100% of dental implants. Depending upon the type of policy you have, you may still need to pay part of the bill out-of-pocket.

CareCredit Financing

Care Credit offers affordable financing to help people like you meet the expenses of getting dental implants. CareCredit financing provides two types of financing plans:

Standard Plan

A fixed payment plan that allows you to repay the total balance in equal monthly installments over a period ranging from 3 to 60 months (depending on the value of the treatment).

Premium Plan

An installment plan with no prepayment repayment penalties allows you to repay only the portion of the total debt that exceeds 25% of your current gross annual salary. You could pay monthly for tooth implants based on an agreed-upon percentage of your outstanding balance.

Other Options

There are many other ways to obtain dental implants financing. One option is to sell items on eBay or Craigslist. Another possibility is to sell your car. Check with local pawn shops to find out if they will buy your vehicle in exchange for cash.

If none of these methods works, it may be necessary to go into debt. However, if you can save enough money to cover the costs of treatment, then you’ll have more flexibility when making decisions regarding your future dental care needs.

Establishing a Payment Plan for Your Implant Treatment

Once you’ve decided to get dental implants, you’ll want to create an implant payment plan. You should set aside funds to pay for your treatment up front. The good news is that you won’t have to wait long for the results of your treatment. The average length between the placement of the final crowns and the first tooth implant that feels normal is about six weeks.

If you’re planning to undergo multiple treatments, be sure to factor in adequate time for healing between appointments.

In some cases, you may have to establish a payment schedule by paying a lump sum at the beginning of your tooth implant treatment. Once this initial Payment is made, you may make smaller payments as needed throughout the process.

In most cases, you can arrange to pay off your entire balance at once. However, be aware of interest charges if you do so. Some providers charge interest on top of the principal balance of your loan. Interest rates typically range between 10% and 20%. When you’re considering different options for financing your tooth implant treatment, it’s essential to calculate all of the fees involved before choosing one method of repayment.

Options for Payment include;

Healthcare Payment Plan

A healthcare payment plan provides financial assistance to individuals who otherwise would not qualify for traditional financing. This program helps patients finance the total amount of their dental treatment through a combination of low dental implants monthly payments and a single large price at the end of the term.

The advantages of healthcare payment plans include:

- No prepayment repayment penalties

- Ability to budget your finances

- Flexible payment terms

- Lower interest rate than credit cards

- One can pay monthly for dental implants

- Affordable coverage for families and individuals

- All forms of dental insurance accepted.

Medicare Part B Deductibles & Maximum Out-of-Pocket Limit

Dental insurance from your employer may provide benefits to help offset dental care costs. These dental insurance programs typically offer coverage limits for services such as cosmetic dentistry (cosmetic work performed outside of the mouth), root canal therapy, crowns, bridges, and orthodontics. Depending on your policy, there may also be a deductible, which is the amount you must pay out of pocket before any benefits kick in.

You can choose to meet the deductible and then submit claims to your insurer for reimbursement, or you can opt for self-pay coverage. Self-pay coverage often includes higher co-pays and deductibles.

There is no maximum out-of-pocket limit with Medicare Part B – however, many plans do have a yearly limit on how much you can spend on health care premiums, including dental care.

Private Health Insurance

How long can you finance dental implants when it comes to private health insurance? Many employers offer private health insurance policies that will reimburse you for certain expenses related to your oral health. To determine whether your particular insurance plan covers dental implants, you’ll need to contact your provider or ask an employee benefits specialist.

Most private health insurance companies require you to purchase additional “credentialing” coverage to cover the cost of dental implant treatments. Credentialing typically involves a review of your medical records before treatment begins.

If you are eligible for credentialing coverage, you should receive a letngs accounts allow you to borrow money from your retirement account without incurring ter confirming your eligibility. If you are denied credentialing, you should request documentation that explains why.

Borrowing from a Retirement Plan

Yes, you can get a loan for teeth implants! Retirement savitaxes until you repay the loan. You can use these funds to pay for dental implant procedure by taking advantage of special rules regarding loans made from qualified retirement plans. Loans took against your 401(k) dental implant payment plan usually involve paying back the money plus interest over time.

Loan interest rates typically run about 8% per year. Repaying your loan early could result in tax consequences because withdrawals from a retirement plan are taxed as ordinary income.

Whether your current insurance doesn’t cover dental implants financing or you’re not able to qualify for a government program, it’s important to seek dental insurance that covers implants when you start planning for future needs.

Most people don’t realize what they can gain from having good oral health. It’s easy to fall behind on preventative measures. Once you start missing teeth, it becomes harder to maintain healthy gums, and more expensive procedures become necessary.

With proper preventive care, you can avoid some costly problems later on. You can achieve long-term financial stability by protecting yourself from unexpected dental bills with the right tooth implant and dental insurance strategy.